CBIC on Thursday night has issued seven new GST Notifications extending the due dates of various returns, amending the rules and return format. New GST Notifications dated 15th October, 2020 are as follows:

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF INDIRECT TAXES AND CUSTOMS)

NOTIFICATION

New Delhi, the 15th October, 2020

No. 74/2020 – Central Tax

G.S.R. 634(E).—In exercise of the powers conferred by section 148 of the Central Goods and Services Tax

Act, 2017 (12 of 2017) (hereafter in this notification referred to as the said Act), the Central Government, on the

recommendations of the Council, hereby notifies the registered persons having aggregate turnover of up to 1.5 crore

rupees in the preceding financial year or the current financial year, as the class of registered persons who shall follow

the special procedure as mentioned below for furnishing the details of outward supply of goods or services or both.

2. The said registered persons shall furnish the details of outward supply of goods or services or both

in FORM GSTR-1 under the Central Goods and Services Tax Rules, 2017, effected during the quarter as specified in

column (2) of the Table below till the time period as specified in the corresponding entry in column (3) of the said

Table, namely:-

| Sl. No. | Quarter for which details in FORM GSTR-1 are furnished | Time period for furnishing details in FORM GSTR-1 |

| 1 | October, 2020 to December, 2020 | 13th January, 2021 |

| 2 | January, 2021 to March, 2021 | 13th April, 2021 |

3. The time limit for furnishing the details or return, as the case may be, under sub-section (2) of section 38 of

the said Act, for the months of October, 2020 to March, 2021 shall be subsequently notified in the Official Gazette.

[F. No. CBEC-20/06/09/2019-GST]

PRAMOD KUMAR, Director

NOTIFICATION

New Delhi, the 15th October, 2020

No. 75/2020 – Central Tax

G.S.R. 635(E).—In exercise of the powers conferred by the second proviso to sub-section (1) of section 37

read with, section 168 of the Central Goods and Services Tax Act, 2017 (12 of 2017) (hereafter in this notification

referred to as the said Act), the Commissioner, on the recommendations of the Council, hereby extends the time-limit for furnishing the details of outward supplies in FORM GSTR-1 of the Central Goods and Services Tax Rules, 2017, by such class of registered persons having aggregate turnover of more than 1.5 crore rupees in the preceding financial year or the current financial year, for each of the months from October, 2020 to March, 2021 till the eleventh day of the month succeeding such month.

2. The time-limit for furnishing the details or return, as the case may be, under sub-section (2) of section 38

of the said Act, for the months of October, 2020 to March, 2021 shall be subsequently notified in the Official Gazette.

[F. No. CBEC-20/06/09/2019-GST]

PRAMOD KUMAR, Director

NOTIFICATION

New Delhi, the 15th October, 2020

No. 76/2020 – Central Tax

G.S.R. 636(E).— In exercise of the powers conferred by section 168 of the Central Goods and Services Tax

Act, 2017 (12 of 2017) (hereafter in this notification referred to as the said Act), read with sub-rule (5) of rule 61 of

the Central Goods and Services Tax Rules, 2017 (hereafter in this notification referred to as the said rules), the

Commissioner, on the recommendations of the Council, hereby specifies that the return in FORM GSTR-3B of the

said rules for each of the months from October, 2020 to March, 2021 shall be furnished electronically through the

common portal, on or before the twentieth day of the month succeeding such month:

Provided that, for taxpayers having an aggregate turnover of up to five crore rupees in the previous financial

year, whose principal place of business is in the States of Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra,

Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands or Lakshadweep, the return in FORM GSTR-3B of the said rules for the months of October, 2020 to March, 2021 shall be furnished electronically through the common portal, on or before the twenty-second day of the month succeeding such month:

Provided further that, for taxpayers having an aggregate turnover of up to five crore rupees in the previous

financial year, whose principal place of business is in the States of Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh or Delhi, the return in FORM GSTR-3B of the said rules for the months of October, 2020 to March, 2021 shall be furnished electronically through the common portal, on or before the twenty-fourth day of the month succeeding such month.

2. Payment of taxes for discharge of tax liability as per FORM GSTR-3B. – Every registered person

furnishing the return in FORM GSTR-3B of the said rules shall, subject to the provisions of section 49 of the said

Act, discharge his liability towards tax by debiting the electronic cash ledger or electronic credit ledger, as the case

may be and his liability towards interest, penalty, fees or any other amount payable under the said Act by debiting the

electronic cash ledger, not later than the last date, as specified in the first paragraph, on which he is required to furnish

the said return.

[F. No. CBEC-20/06/09/2019-GST]

PRAMOD KUMAR, Director

NOTIFICATION

New Delhi, the 15th October, 2020

No. 77/2020 – Central Tax

G.S.R. 637(E).— In exercise of the powers conferred by section 148 of the Central Goods and Services Tax

Act, 2017 (12 of 2017) (hereinafter referred to as the said Act), the Central Government, on the recommendations of

the Council, hereby makes the following amendment in the notification of Government of India in the Ministry of

Finance, (Department of Revenue), No. 47/2019 – Central Tax dated the 9th October, 2019, published in the Gazette of

India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 770(E), dated the 9th October, 2019,

namely: –

In the said notification in the opening paragraph, for the words and figures “financial years 2017-18 and

2018-19”, the words and figures “financial years 2017-18, 2018-19 and 2019-20” shall be substituted.

[F. No. CBEC-20/06/09/2019-GST]

PRAMOD KUMAR, Director

Note: The principal notification No. 47/2019 – Central Tax, dated the 9th October, 2019 was published in the

Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 770(E), dated the 9th

October, 2019.

NOTIFICATION

New Delhi, the 15th October, 2020

No. 78/2020 – Central Tax

G.S.R. 638(E).— In exercise of the powers conferred by the first proviso to rule 46 of the Central Goods and

Services Tax Rules, 2017, the Central Board of Indirect Taxes and Customs, on the recommendations of the Council,

hereby makes the following amendment in the notification of the Government of India in the Ministry of Finance

(Department of Revenue), No.12/2017 – Central Tax, dated the 28th June, 2017, published in the Gazette of India,

Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 660(E), dated the 28th June, 2017, namely:–

In the said notification, with effect from the 01st day of April, 2021, for the Table, the following shall be

substituted, namely, –

| Sl. No. | Aggregate Turnover in the preceding Financial Year | Number of Digits of Harmonised System of Nomenclature Code (HSN Code) |

| 1 | Up to rupees five crores | 4 |

| 2 | more than rupees five crores | 6 |

Provided that a registered person having aggregate turnover up to five crores rupees in the previous financial

year may not mention the number of digits of HSN Code, as specified in the corresponding entry in column (3) of the

said Table in a tax invoice issued by him under the said rules in respect of supplies made to unregistered persons.”.

[F. No. CBEC-20/06/09/2019-GST]

PRAMOD KUMAR, Director

Note: The principal notification number 12/2017 – Central Tax, dated the 28th June, 2017, published in the Gazette

of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 660(E), dated the 28th June,

2017.

NOTIFICATION

New Delhi, the 15th October, 2020

No. 79/2020–Central Tax

G.S.R. 639(E).—In exercise of the powers conferred by section 164 of the Central Goods and Services Tax

Act, 2017 (12 of 2017), the Central Government, on recommendations of the Council, hereby makes the following

rules further to amend the Central Goods and Services Tax Rules, 2017, namely: –

1. Short title and commencement. – (1) These rules may be called the Central Goods and Services Tax

(Twelveth Amendment) Rules, 2020.

(2) Save as otherwise provided in these rules, they shall come into force on the date of their publication in the

Official Gazette.

2. In the Central Goods and Services Tax Rules, 2017 (hereinafter referred to as the said rules), in rule 46,

for the first proviso, the following proviso shall be substituted, namely: –

“Provided that the Board may, on the recommendations of the Council, by notification, specify-

(i) the number of digits of Harmonised System of Nomenclature code for goods or services that a class of

registered persons shall be required to mention; or

(ii) a class of supply of goods or services for which specified number of digits of Harmonised System of

Nomenclature code shall be required to be mentioned by all registered taxpayers; and

(iii) the class of registered persons that would not be required to mention the Harmonised System of

Nomenclature code for goods or services:”.

3. In the said rules, for rule 67A, the following rule shall be substituted, namely: –

“67A. Manner of furnishing of return or details of outward supplies by short messaging service

facility.- Notwithstanding anything contained in this Chapter, for a registered person who is required to furnish a Nil

return under section 39 in FORM GSTR-3B or a Nil details of outward supplies under section 37 in FORM GSTR-1

or a Nil statement in FORM GST CMP-08 for a tax period, any reference to electronic furnishing shall include

furnishing of the said return or the details of outward supplies or statement through a short messaging service using

the registered mobile number and the said return or the details of outward supplies or statement shall be verified by a

registered mobile number based One Time Password facility.

Explanation. – For the purpose of this rule, a Nil return or Nil details of outward supplies or Nil statement

shall mean a return under section 39 or details of outward supplies under section 37 or statement under rule 62, for a

tax period that has nil or no entry in all the Tables in FORM GSTR-3B or FORM GSTR-1 or FORM GST

CMP-08, as the case may be.”.

4. In the said rules, in rule 80, in sub-rule (3), for the proviso, the following proviso shall be substituted,

namely: –

“Provided that for the financial year 2018-2019 and 2019-2020, every registered person whose aggregate

turnover exceeds five crore rupees shall get his accounts audited as specified under sub-section (5) of section 35 and

he shall furnish a copy of audited annual accounts and a reconciliation statement, duly certified, in FORM GSTR-9C

for the said financial year, electronically through the common portal either directly or through a Facilitation Centre

notified by the Commissioner.”.

5. In the said rules, with effect from the 20th day of March, 2020, in rule 138E, after the third proviso, the

following proviso shall be inserted, namely: –

“Provided also that the said restriction shall not apply during the period from the 20th day of March, 2020 till

the 15th day of October, 2020 in case where the return in FORM GSTR-3B or the statement of outward supplies in

FORM GSTR-1 or the statement in FORM GST CMP-08, as the case may be, has not been furnished for the period

February, 2020 to August, 2020.”.

6. In the said rules, in rule 142, in sub-rule (1A), –

(i) for the words “proper officer shall”, the words “proper officer may” shall be substituted;

(ii) for the words “shall communicate”, the word “communicate” shall be substituted.

7. In the said rules, in FORM GSTR-1, against serial number 12, in the Table, in column 6, in the heading,

for the words “Total value”, the words “Rate of Tax” shall be substituted.

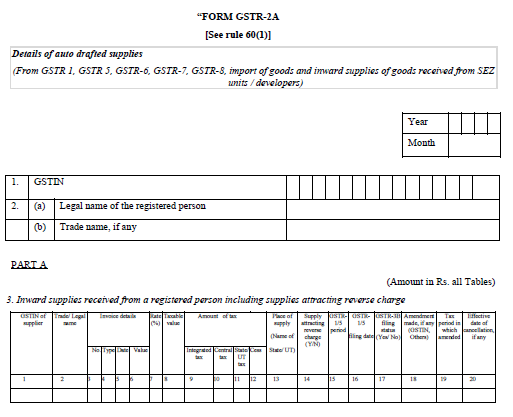

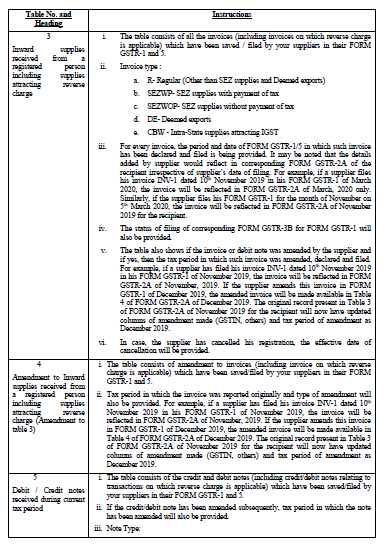

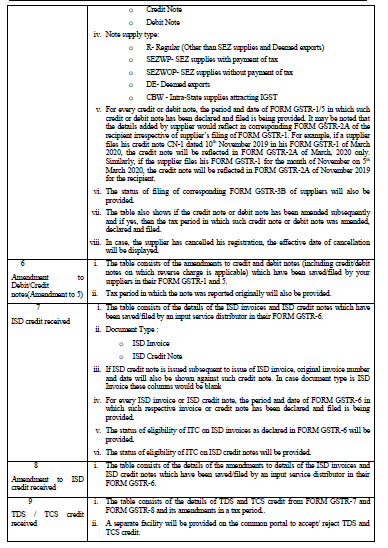

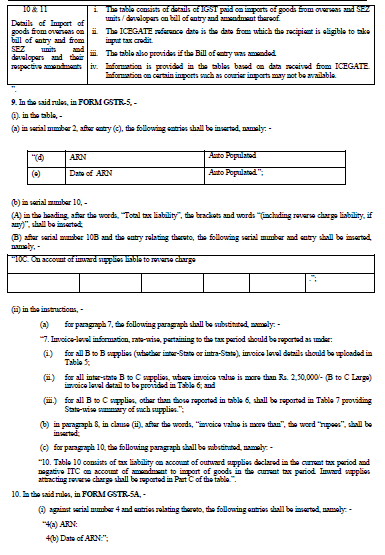

8. In the said rules, for FORM GSTR-2A, the following form shall be substituted, namely

(B) in the Table, in second column, for the letters, figures and word “FY 2017-18 and 2018-19” wherever they occur, the letters, figures and word “FY 2017-18, 2018-19 and 2019-20” shall be substituted;

(c) in paragraph 5, in the Table, in second column, –

(A) against serial number 6B, after the entries, the following entry shall be inserted, namely: –

“For FY 2019-20, the registered person shall report the breakup of input tax credit as capital goods and have an option to either report the breakup of the remaining amount as inputs and input services or report the entire remaining amount under the “inputs” row only.”;

(B) against serial number 6C and serial number 6D, –

(i) after the entry ending with the words “entire input tax credit under the “inputs” row only.”, the following entry shall be inserted, namely: –

“For FY 2019-20, the registered person shall report the breakup of input tax credit as capital goods and have an option to either report the breakup of the remaining amount as inputs and input services or report the entire remaining amount under the “inputs” row only.”;

(ii) in the entry ending with the words, figures and letters “Table 6C and 6D in Table 6D only.”, for the letters, figures and word “FY 2017-18 and 2018-19”, the letters, figures and word “FY 2017-18, 2018-19 and 2019-20” shall be substituted;

(C) against serial number 6E, after the entry, the following entry shall be inserted, namely: –

“For FY 2019-20, the registered person shall report the breakup of input tax credit as capital goods and have an option to either report the breakup of the remaining amount as inputs and input services or report the entire remaining amount under the “inputs” row only.”;

(D) against serial number 7A, 7B, 7C, 7D, 7E, 7F, 7G and 7H, in the entry, for the letters, figures and word “FY 2017-18 and 2018-19”, the letters, figures and word “FY 2017-18, 2018-19 and 2019-20” shall be substituted.;

(E) against serial number 8A, after the entry, the following entry shall be inserted, namely: –

“For FY 2019-20, it may be noted that the details from FORM GSTR-2A generated as on the 1st November, 2020 shall be auto-populated in this table.”;

(F) against serial number 8C, for the entries, the following entry shall be substituted, namely:-

“Aggregate value of input tax credit availed on all inward supplies (except those on which tax is payable on reverse charge basis but includes supply of services received from SEZs) received during the financial year for which the annual return is being filed for but credit on which was availed in the next financial year within the period specified under Section 16(4) of the CGST Act, 2017.”;

(d) in paragraph 7, –

(A) after the words and figures “April 2019 to September 2019.”, the following shall be inserted, namely: –

“For FY 2019-20, Part V consists of particulars of transactions for the previous financial year but paid in the FORM GSTR-3B between April 2020 to September 2020.”;

(B) in the Table, in second column, –

(I) against serial number 10 & 11, after the entries, the following entry shall be inserted, namely: –

“For FY 2019-20, Details of additions or amendments to any of the supplies already declared in the returns of the previous financial year but such amendments were furnished in Table 9A, Table 9B and Table 9C of FORM GSTR-1 of April 2020 to September 2020 shall be declared here.”;

(II) against serial number 12, –

(1) in the entry beginning with the word, letters and figures “For FY 2018-19” after the words “for filling up these details.”, the following entry shall be inserted, namely: –

“For FY 2019-20, Aggregate value of reversal of ITC which was availed in the previous financial year but reversed in returns filed for the months of April 2020 to September 2020 shall be declared here. Table 4(B) of FORM GSTR-3B may be used for filling up these details. For FY 2019-20, the registered person shall have an option to not fill this table.”;

(2) in the entry beginning with the word, letters and figures “For FY 2017-18” and ending with the words “an option to not fill this table.”, for the letters, figures and word “FY 2017-18 and 2018-19”, the letters, figures and word “FY 2017-18, 2018-19 and 2019-20” shall be substituted;

(III) against serial number 13, –

(1) in the entry beginning with the word, letters and figures “For FY 2018-19” after the words, letters and figures “in the annual return for FY 2019-20.”, the following entry shall be inserted, namely: –

“For FY 2019-20, Details of ITC for goods or services received in the previous financial year but ITC for the same was availed in returns filed for the months of April 2020 to September 2020 shall be declared here. Table 4(A) of FORM

GSTR-3B may be used for filling up these details. However, any ITC which was reversed in the FY 2019-20 as per second proviso to sub-section (2) of section 16 but was reclaimed in FY 2020-21, the details of such ITC reclaimed shall be furnished in the annual return for FY 2020-21.”;

(2) in the entry beginning with the word, letters and figures “For FY 2017-18” and ending with the words “an option to not fill this table.”, for the letters, figures and word “FY 2017-18 and 2018-19”, the letters, figures and word “FY 2017-18, 2018-19 and 2019-20” shall be substituted;

(e) in paragraph 8, in the Table, in second column, for the letters, figures and word “FY 2017-18 and 2018-19” wherever they occur, the letters, figures and word “FY 2017-18, 2018-19 and 2019-20” shall be substituted.

12. In the said rules, in FORM GSTR-9C, in the instructions, –

(i) in paragraph 4, in the Table, in second column, for the letters, figures and word “FY 2017-18 and 2018-19” wherever they occur, the letters, figures and word “FY 2017-18, 2018-19 and 2019-20” shall be substituted;

(ii) in paragraph 6, in the Table, in second column, for the letters, figures and word “FY 2017-18 and 2018- 19” wherever they occur, the letters, figures and word “FY 2017-18, 2018-19 and 2019-20” shall be substituted.

13. In the said rules, in FORM GST RFD-01, in Annexure-1, in Statement-2, in the heading the brackets, word and

letters “(accumulated ITC)”, shall be omitted.

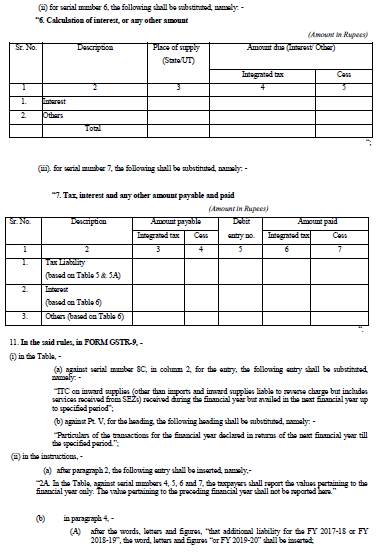

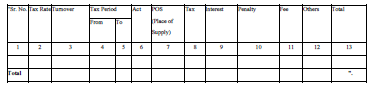

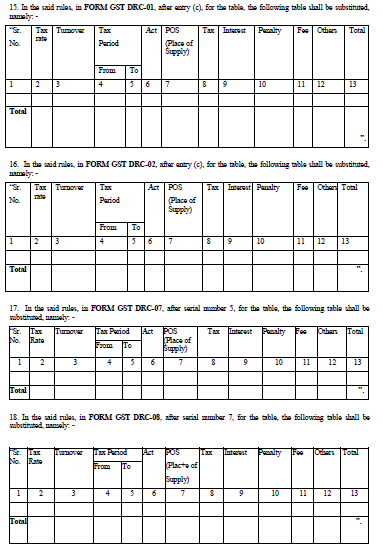

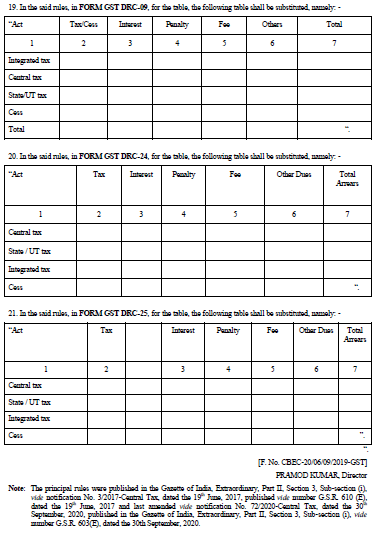

14. In the said rules, in FORM GST ASMT-16, for the table, the following table shall be substituted, namely: –

Visit CBIC website.

NOTIFICATION

New Delhi, the 15th October, 2020

No. 06/2020–Integrated Tax

G.S.R. 640(E).— In exercise of the powers conferred by the first proviso to rule 46 of the Central Goods and Services Tax Rules, 2017, read with notification No. 4/2017-Integrated Tax, dated the 28th June, 2017, the Central Board of Indirect Taxes and Customs, on the recommendations of the Council, hereby makes the following amendment in notification of the Government of India in the Ministry of Finance (Department of Revenue), No.5/2017 – Integrated Tax, dated the 28th June, 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 697(E), dated the 28th June, 2017, namely:–

In the said notification, with effect from the 01st day of April, 2021, for the Table, the following shall be substituted, namely, –

| Sl. No. | Aggregate Turnover in the preceding Financial Year | Number of Digits of Harmonised System of Nomenclature Code (HSN Code) |

| 1 | Up to rupees five crores | 4 |

| 2 | more than rupees five crores | 6 |

Provided that a registered person having aggregate turnover up to five crores rupees in the previous financial year may not mention the number of digits of HSN Code, as specified in the corresponding entry in column (3) of the said Table in a tax invoice issued by him under the said rules in respect of supplies made to unregistered persons.”.

[F. No. CBEC-20/06/09/2019-GST]

PRAMOD KUMAR, Director

Note: The principal notification number 5/2017 – Integrated Tax, dated the 28th June, 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 697(E), dated the

28th June, 2017.

Click here to download all above notifications.

Click here to view other news relating to GST.