Bharti Airtel Limited Vs Union of India & Ors. | Delhi High Court | GSTR 3B Rectification | W.P.(C) 6345/2018:

| Case Law Summary: | |

| Case Name : | Bharti Airtel Limited Vs Union of India & Ors. (Delhi High Court) |

| Appeal Number : | W.P. No. 6345/2018 |

| Date of Judgement/Order : | 5th May, 2020 |

The GST Act came in force from 1st July, 2017. There were many interpretation issues with respect to the definitions, notifications and circulars and terms use in the law. Since, such circulars and notifications sometimes override the statutory laws or are ultra vires. Hence, a judicial systems are placed to decide the question of law involved in the particular case. Therefore, it is important to keep a track on the recent case laws and judgement which can be helpful in deciding the case. The Case Law/ Judgement Order discussed here is of Delhi High Court relating to Bharti Airtel Limited v/s Union of India ORS. The matter is relating to Bharti Airtel Limited vs Union of India.

Brief Facts of the Case of Bharti Airtel Limited vs Union of India:

- Bharti Airtel Limited (i.e. petitioner) engaged in the business of providing Telecommunication services.

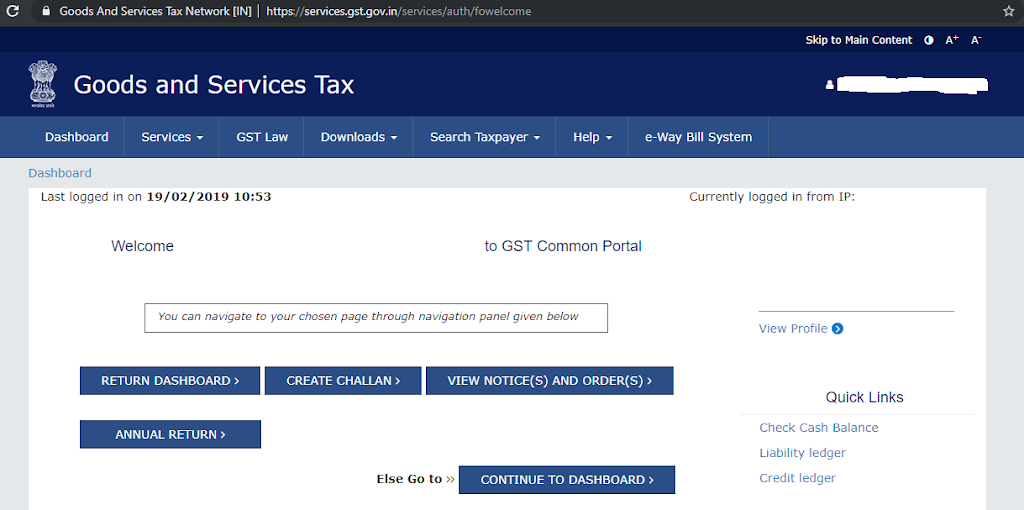

- During transitional phase, petitioner faced several issues while filing Form GSTR 3B for July’17 to September’17 due to non functional of GSTIN portal properly.

- During this period, ITC was availed on estimated basis. Later on when GSTR 2A was operationalized, it discovered that tax amounting to INR 923 crores was excess paid in cash and ITC was under-reported.

- This was occasioned to a great degree due to non-operationalization of Forms GSTR-2A, GSTR-2 and GSTR-3 and the system related checks which could have forewarned the petitioner about the mistake.

- Moreover, since there were no checks on the Form GSTR-3B which was manually filled up by the Petitioner, the excess payment of tax went unnoticed.

- Petitioner now desires to correct its returns, but is being prevented from doing so, as there is no enabling statutory procedure implemented by the Government.

Question of Issue in Bharti Airtel Limited Vs Union of India & Ors.:

- Whether Rule 61(5) of the CGST Rules, 2017, Form GSTR 3B and Master Circular 26/26/2017-GST dated 29.12.2017 which do not provide for modification of the information to be furnished in the return of the tax period to which such information relates are in line with statutory provisions of the CGST Act, 2017?

Analysis of W.P.(C) 6345/2018, GSTR 3B Rectification:

- CGST Act and CGST rules provides for verification, validation, modification and deletion of information in particular tax period through FORM GSTR 1/2A and 3.

- However, due to and under preparedness of GSTIN portal, FORM GSTR 2 and 3 were not made operational. 2A was made operational only in September 2018 by CBIC.

- Hence, Government introduced Rule 61(5) (which was amended vide Notification No. 17/2017-CT dated 27.07.2017) and Rule 61(6), which provided for filing of monthly return in Form GSTR 3B (i.e. summary return)

- Form GSTR-3B is filled in manually by each registered person and has no inbuilt checks and balances by which it can be ensured that the data uploaded by each registered person is accurate, verified and validated.

- Therefore, the design and scheme of the Act as envisioned has not been entirely put into operation as yet.

- Petitioner’s ITC claim was based on estimation and the exact amount for the relevant period was not known

- Petitioner discharged the GST liability for the relevant period in cash, although, in reality,

- ITC was available with it. (though it was not reflected in the system on account of lack of data)

- Form GSTR-3B as introduced by Rule 61 (5) being at variance with the other statutory provisions does not permit the data validation before it is uploaded.

- The statutory provisions, therefore, provided not just for a procedure but a right and a facility to a registered person by which it can be ensured that the ITC availed, and returns can be corrected in the very month to which they relat; and the registered person is not visited with any adverse consequences for uploading incorrect data.

- In terms of Circular No. 26/26/2017-GST, any adjustment of tax liability/ input tax credit is permissible in subsequent months.

- The High Court said that para 4 of Circular No. 26/26/2017-GST dated 29.12.2017 is not in consonance with the provisions of CGST Act, 2017 as it has restricted the mechanism of rectification in the same period.

- There is no provision under the Act that would restrict such rectification.

- Also, in the case of Commissioner of Central Excise, Bolpur vs. Ratan Melting and Wire Industries, (2008) 13 SCC 1, it was held by the Hon’ble Supreme Court that a circular which is contrary to the statutory provisions has really no existence in law.

- Therefore, the design and scheme of the Act as envisioned has not been entirely put into operation yet.

- Accordingly, the Petitioner was permitted to rectify Form GSTR-3B for the period to which the error relates, i.e. the relevant period from July, 2017 to September, 2017.

- The High Court also direct the Respondents that on filing of the rectified Form GSTR-3B; they shall; within a period of two weeks, verify the claim made therein and give effect to the same once verified.

Download below a power point presentation on Bharti Airtel Limited vs UOI in pdf format for your ready reference.

Download power point presentation on Bharti Airtel Ltd vs UOI (W.P.(C) 6345 2018) in pdf format.

Download Judgement Order Here.