Introduction:

The GST Act came in force from 1st July, 2017. There were many interpretation issues with respect to the definitions, glossary and terms use in the law. Since, such definitions were adopted from various legacy laws in India prior to ST; such as Service Tax, State VAT, Central Excise Act, Luxury Tax, Entertainment Tax, etc. it was difficult to make applicable one definition for different sectors. Hence, some modifications from existing definitions were made. Therefore, it was important to established a nexus of the terms used in the GST definitions. The definition discussed here is “Aggregate Turnover”.

So what do you mean by “Aggregate Turnover”?

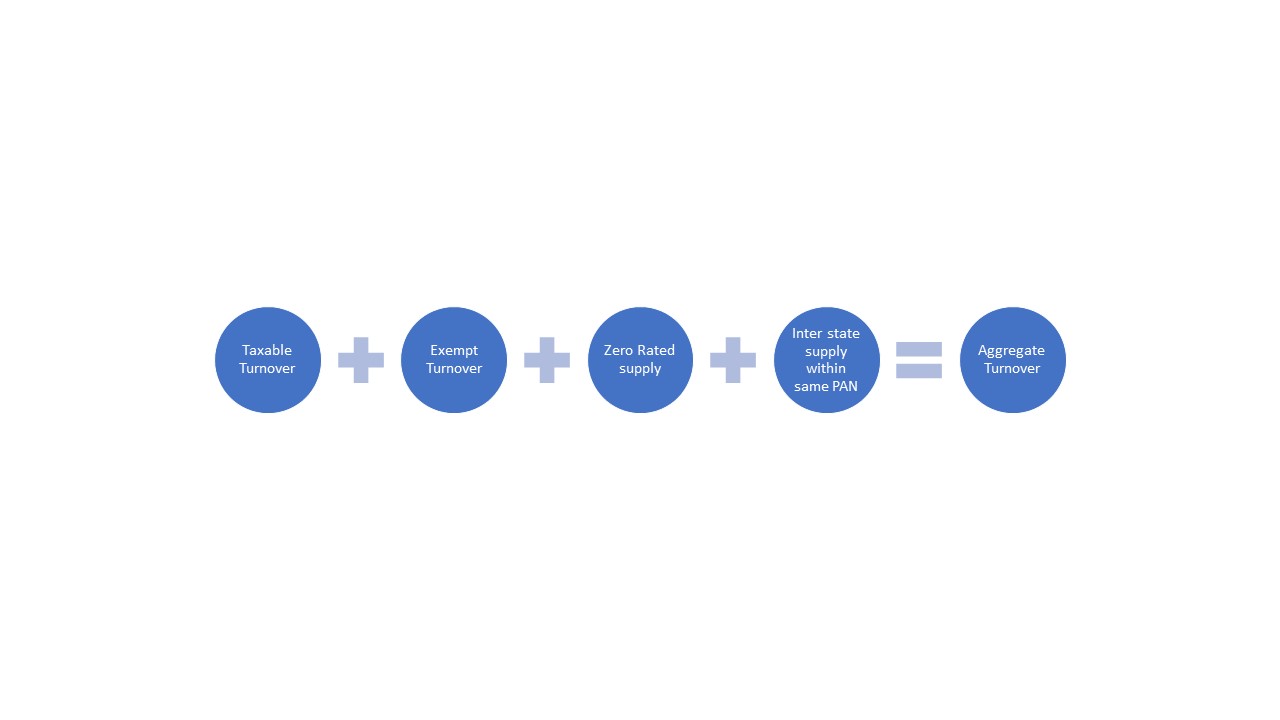

Section 2(6) of CGST Act, 2017 – “aggregate turnover” means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both and inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes central tax, State tax, Union territory tax, integrated tax and cess;

Conclusion:

Hence, it is understood that the entire turnover of taxable, exempt and export would be included excluding turnover of reverse and taxes.

The same can be accessed on GST portal.

⇐ Section 2(5) Agent ⇒ ⇐Section 2(7) Agriculturist ⇒