GST Returns with EVC:

Its almost 3 years of introduction of Goods and Services Tax in India. However, taxpayers were still facing Digital Signature Certificate related issues in GST. Many a times, due to Digital Signature Certificates issues, the GST return filing gets delayed and taxpayers were left paying interest and late filing fees due to such errors. Therefore, it was a need to introduce Electronic Verfication Code for corporate as well to file their GST return through it. Please note that, Individuals were having such facility from inception to file GST return with EVC. Hence, on 21st April, 2020, this facility got enabled on the GST portal for Corporate taxpayers that they can now file their GST returns through EVC. A welcome decision by corporates from the department that Corporates can now file GST Returns with EVC Electronic Verification Code.

The process for filing GST return through EVC are as follows:

- First filled all required details in GST Returns on GST portal and when you are on final stage to file your returns, go to step no. 2. If you not filled the details yet then first fill details in GST return.

- Click on proceed to file (as displayed in the below image)

- Once you click proceed to file following information will flash on the screen. Select the checkbox to accept the declaration.

- From the Authorised Signatory drop-down list, select the authorized signatory.

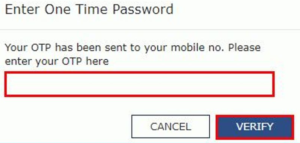

- Click the FILE GSTR-3B WITH EVC button or other type of Return option to File GST Return with EVC.

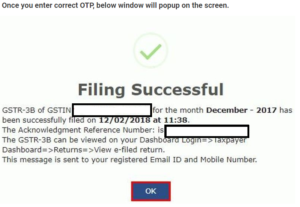

Post filing of GST return with EVC, the GST returns can be downloaded in PDF format and filing status can be viewed either by selecting particular month or selecting User Service>>Returns>>View Filed returns. To access the GST portal for downloading the returns, please click here.