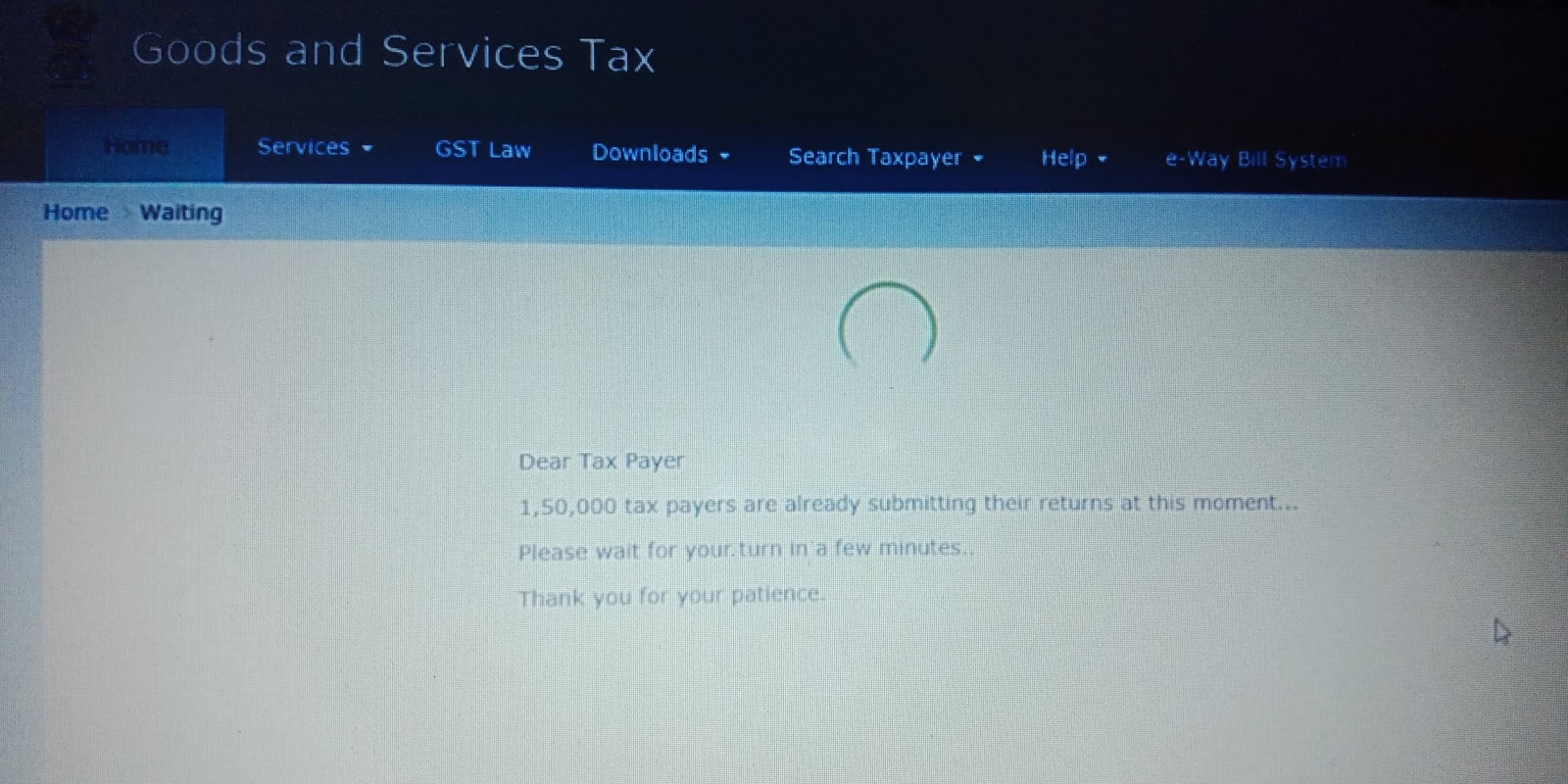

Last date for filing GSTR 3B for September 2018 was basically 20th October 2018 where businesses faced multiple types of problems to file duly return. It was almost become impossible to file the return. While logging to GST portal, an error was popup that already 150,000 taxpayers are filing the return. Please wait for your turn.

Check this Screenshot for reference.

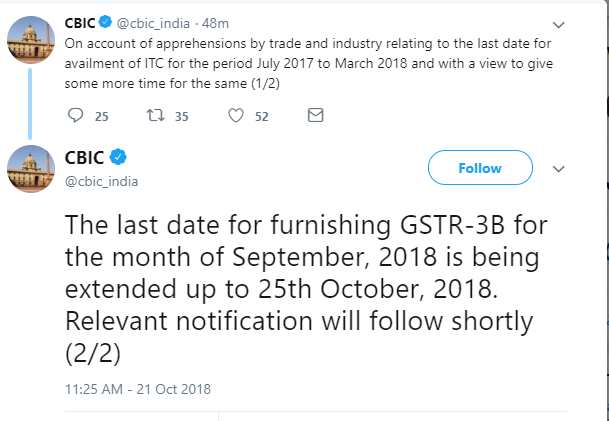

CBIC (The Central Board of Indirect Taxes and Customs) under the Finance Ministry, said trade and industry had expressed apprehension relating to October 20 due date for claiming ITC under GST for July 2017-March 2018.

CBIC tweeted on Sunday “On account of apprehensions by trade and industry relating to the last date for availment of ITC for the period July 2017 to March 2018 and with a view to give some more time for the same the last date for furnishing GSTR-3B for the month of September, 2018 is being extended up to 25th October, 2018. Relevant notification will follow shortly” Check the screenshot below.

This extension came as a shocking news for almost every business as last date for closing GSTR 3B summary sales return has to be filed by the 20th day of the subsequent month but this news came in light on 21st October 2018.

However a representation is given by Central Gujarat chamber of tax consultants which is as follow.

To,

Shri Arun Jaitley

Hon’ Finance Minister of India

Dear Sir,

Greetings from CGCTC

Re : Humble request for extension of due date for filling of GSTR 3B for the month of September’ 2018

We, the Central Gujarat Chamber of Tax Consultants would like to draw your kind attention regarding issue of non working of GST portal. Our members as well as the tax payers are facing difficulties in making payment and uploading of GSTR 3B.

This in turn has lead to a situation wherein neither tax is being paid nor the returns are being filed. In case where tax is paid / debited in the bank account of the dealer, the same is not reflected in the Cash ledger of the dealer, forcing the dealer to keep the return filing in abeyance.

It may kindly be noted that if the GST3B would not file today, it would lead to :

1) A dealer is unable to avail Input Tax Credit of any inward supply for F.Y. 2017-18, according to the provisions of Section 16(4).

2) A dealer would be liable to pay late fees automatically from the midnight of last Day of filing of return i.e. 20th Octobert’ 2018, without any default from part of the dealer.

The Government too is losing out revenue due to the issues of system.

We are sure that your Honor would appreciate the concerns raised by us and extend the due date of filing of GSTR 3B for the month of September’ 2018 till 31st December 2018, so that the ITC of FY 2017-18 can’t lapsed and further to make it in tune with due date of filing of Annual Return as mentioned in provision of sec. 16(4) OR in alternate would be pleased to forward before GST Council.

On the part of the Association, we assure you full support and cooperation in creating and fostering a spirit of understanding between the Tax Authorities and Tax Payers as we always have.

Yours Faithfully

for CENTRAL GUJARAT CHAMBER OF TAX CONSULTANTS

(KINJAL K. SHAH)

Hon. Secretary

Copy to

– Shri Hasmukh Adhia, Revenue Secretary

– Dr. P. D. Vaghela, Chief Commisssioner of GST, State Tax, Ahmedabad.

– Shri Ajay Jain, Chief Commisssioner of GST, Central Tax, Ahmedabad.

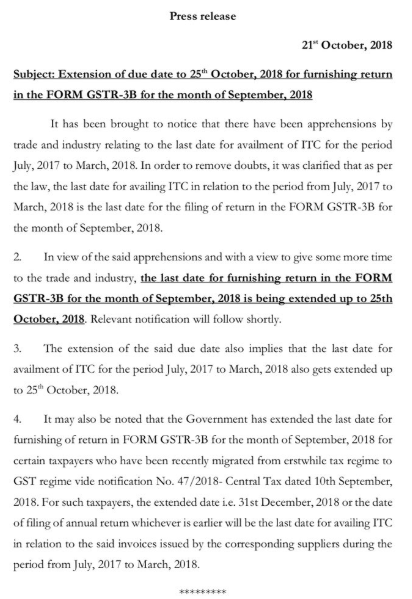

The press release is as follows: