GST Return Filing in Warthi Overview

Why choose MyGSTHub to file the GST returns in Warthi?

- Dedicated Professional GST Expert: At MyGSTHub we assign a GST Expert with experience in the sector that you are operating in. The assigned Expert will help with specific tasks such as uploading the invoices and ensuring that the filing of the returns is done on time.

- Reminder to file the GST returns: MyGSTHub ensures that timely reminders are sent well in advance to all clients. In addition to this, the expert will also remind you about the deadlines so that the deadlines are never missed.

- Monthly GST Status reports: A Detailed Monthly report of the status of the GST filing in Warthi including the Form GSTR-1 and Form GSTR-3B Filing and the way forward will be shared with the clients by our GST experts.

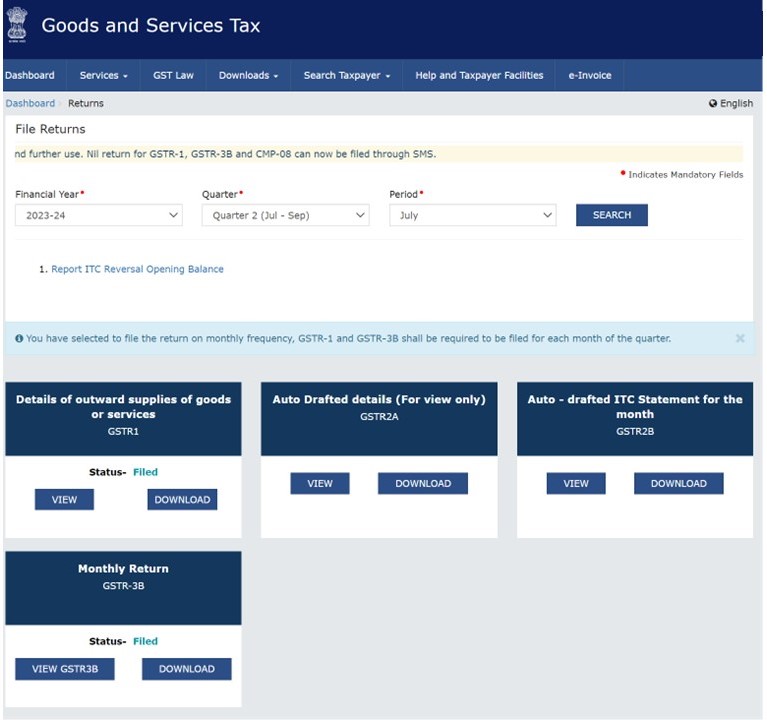

- GST returns filing through Software: The GST returns are prepared and filed by GST software so that it is error-free and filed seamlessly without any hassles. However, it can also be filed through GST portal.

- GSTR 1 and GSTR 3B filing: Form GSTR-1 is a return filed every month/ quarter depending on the turnover of the Taxpayer. The turnover determines the due dates for filing GSTR 1. Businesses with sales of up to INR 1.5 crore can file quarterly returns and others are required to file them monthly. Form GSTR-3B is either filed quarterly/ monthly based on the above scenarios. However, in the case of a quarterly filer, the tax has to be paid on a monthly basis as per the QRMP scheme.

GST Return Filing in Warthi Fees & Plan

| Service Sector | Goods Sector |

|---|---|

| ₹ 1,300/- per month | ₹ 1,800/- per month |

Who needs to file GST returns in Warthi?

All Registered Taxpayer has to file GST returns.

How to file GST returns in Warthi?

The GST returns are filed monthly, quarterly, or annually depending on the type of taxpayers.

Why to File GST Returns?

The Registered Taxpayer is bound to comply with the provisions of GST Acts and Rules, which state that every registered taxpayer shall file the returns.

Avoid Late Filing Fees, Interest and Penalties

MyGSTHub tax expert shall file your GST returns within the timelines to avoid any interest, late fees, and other penalties. The Interest is 18% per annum for non-payment of tax liability. The per-day late fees are based on the turnover of the taxpayers.

Claiming of Input Tax Credit

The essential element of filing the GST return is to match and avail Input tax credit (ITC) which is uploaded and paid by the supplier. The Eligible Input tax credit can be availed if the supplier has paid the taxes. Here, MyGSTHub provides this facility to reconcile your business input tax credit and avoid losing any ITC.

Claim Refund of Taxes

The refund can be claimed only in a few scenarios by the Taxpayers. MyGSTHub’s expertise is in getting timely refunds as its GST expert liaises with the department officers on a continuous basis. We at MyGSTHub can make your GST refund process hassle-free and you can concentrate on your business.

Benefits of Timely Compliances of GST

The biggest benefit of timely compliance is no payment of interest, late fees and other penalties as the compliances are done on time. It also enhances the smooth functioning of the business. The GST department with the use of AI picks up the taxpayers who are not timely compliant and issue notices.

Documents required for GST Return filing in Warthi

- Sales register

- Credit note register

- Debit note register

- Purchase register

- Bank Statement

[wpforms id=”1329″]