Finally a relaxing news for all taxpayers as on request of ICAI (Institute of Chartered Accountants of India) to CBDT (Central Board of Direct Taxation) for extending time or submission of Tax Audit Reports and related returns from 30th September, 2018 to 31st October, 2018. CBDT has not followed Norms of Earlier Years of discussing Important Changes in Tax Audit Report with ICAI, there was Constant changes in Utilities relating to Tax Audit Forms, Delay in release of utilities and there were Issue in utility of ITR Form No. 5.

On 31.08.2018 ICAI has made a similar representation to extend due date to 31st October, 2018.

On 17.09.2018 ICAI has made a similar representation to extend Tax Audit Reports & ITR.

(Set up by an Act of Parliament)

ICAI/DTC/2018-19/Rep – 34

10th September, 2018

Shri Sushil Chandra Ji,

Chairman,

Central Board of Direct Taxes,

Ministry of Finance,

Government of India,

North Block,

New Delhi-110 001.

Respected Sir,

Further submissions: Reg. our representation dated 31st August, 2018 for extension of time for submission of Tax Audit Reports and related returns from 30th September, 2018 to 31st October, 2018.

This has a reference to the representation no. ICAI/DTC/2018-19/Rep — 27 dated 31st August,2018 submitted to your good office with a request for extension of time for submission of Tax Audit Reports and related returns from 30th September, 2018 to 31st October, 2018.

As you are kindly aware that ‘ICAI, being a partner in nation building, has always tried to strengthen the relationship between the taxpayers and the Department by placing before your good office, the difficulties being faced by assessees in respect of matters relating to direct taxes for appropriate solution. In view of the same, members have raised their concerns which were enumerated in the aforementioned representation.

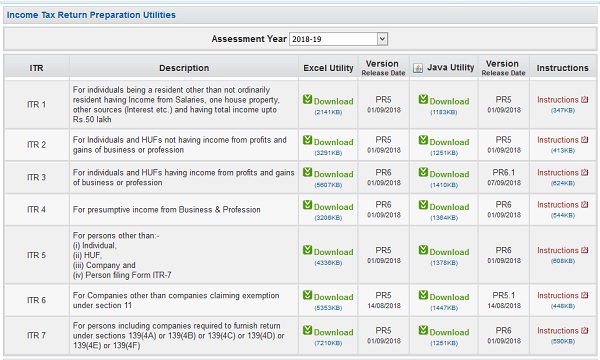

1. Delay in release of utilities:

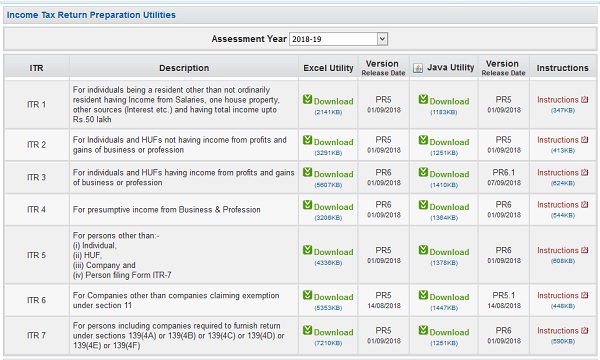

Due to the delay in e-enabling of return forms, the effective time available for filing of return of income became very less, causing genuine hardship to the assessees and members of the profession. The table below shows the effective time available for filing return of income/tax audit report(TAR) of A.Y.2018-19 whose last date for filing return of income/TAR falls due on 30th September, 2018:

Follow this table for further updates on dates and notifications.

|

S. No.

|

ITRForms/TAR

|

Time available for filing return of income/ TAR (from the end of the relevant financial year) days

|

Date of Notification

|

Date of enabling E-Filing

|

Delay in release of enabling e-filing utility

|

Effective time available for filing of return of income/ TAR (from the date of enabling)

|

Number of times utility modified after release in Java version

|

Last modified date

|

|

1

|

ITR 3

|

|

03.04.2018

|

18.05.2018

|

48 days

|

135

days

|

5

|

07.09.2018

|

|

2

|

ITR 5 & 7

|

183 days

|

03.04.2018

|

21.05.2018

|

51 days

|

132 days

|

5

|

01.09.2018

|

|

3

|

ITR 6

|

183 days

|

03.04.2018

|

26.05.2018

|

56 days

|

127 days

|

4

|

14.08.2018

|

|

4

|

Form 3CA,3CB, 3CD

|

183 days

|

20.07.2018

|

20.08.2018

|

143 days

|

40 days

|

5

|

07.09.2018

|

2. It is pertinent to mention that in the year 2006-07 when the tax audit report was revised through Notification No. 208/2006 dated 10.8.2006, the same was made effective prospectively for AY 2007-08 and not retrospectively. Intact, in the AY 2006-07, despite of applicability of new forms prospectively, the due date of filing tax audit reports and their corresponding ITR were extended to 30th November, 2006. Similar approach should have been adopted this time also.

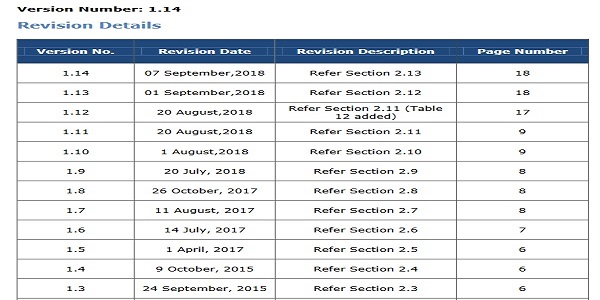

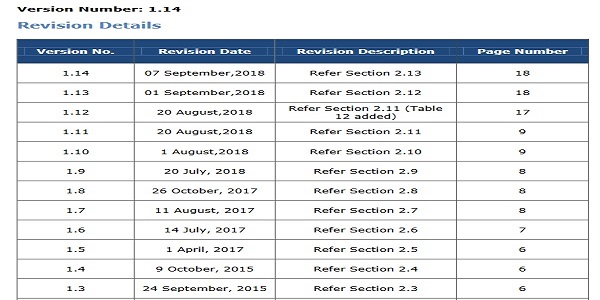

3. Constant changes in Utilities relating to Tax Audit Forms:

Continuous and regular updations are being made to the utility of Form No. 3CA/3CD and

3CB/3CD . Recently, the department has released/amended the utility of Form No. 3CB on 7th September 2018. Due to the frequent changes in the utilities, tax payers are facing difficulties in filing their tax audit reports efficiently as they need time to digest the changes. Such changes are causing further time consumption on the part of members.

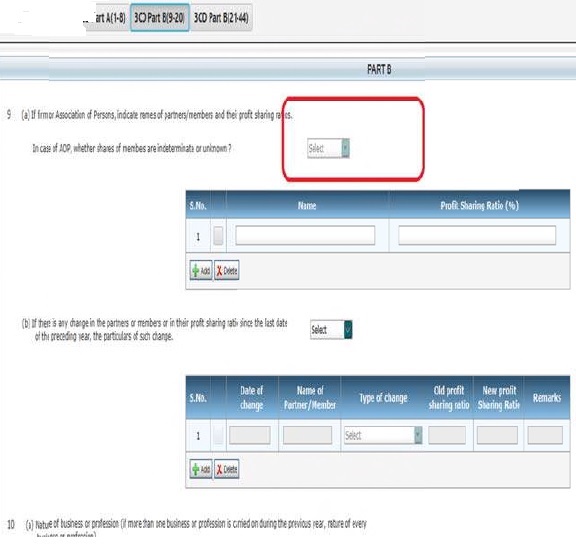

Further, the changes made in the utility on 1st September, 2018 in Clause No. 9(a) of Form No. 3CB, there is a requirement of mentioning the details of the partners of the firm, which is a mandatory field. The present utility does not allow the assessee to enter any data in this field and the field is locked, inspite of the status of the assessee selected as partnership firm. Kindly refer to the representation no. ICAI/DTC/2018- 19/Rep – 32 dated 07th September,2018 highlighting the same. There has been no further update in this matter and the partnership firm’s auditors are not able to complete their audits due to this error.

The relevant screenshot of the error is as below:

The relevant screenshots of ITR Forms & Form 3CD utilities updation are as under:

The main cause of concern for our members is that they need sufficient time to discharge all their professional obligations in an effective manner. It is also to be noted that whenever there is a schema change and the release of new utility by the CBDT, it requires time to understand the changes made in comparison to the earlier version. It is also seen that whenever the new utility is released, there are issues specially relating to the blocking of the mandatory fields for reporting, resulting in delay for completion of audit (Refer Point-2 for blocking of Clause 9(a) field).

Many assessees and auditors are using the softwares which are prepared by the software providers, based on the schema released by the CBDT. The software vendors take almost around a week’s time to update the software after the schema is released, due to which the working days get reduced.

More particularly, it is also our concern that the quality of audit conducted by them should not be compromised in any manner due to lack of sufficient time.

4. Issue in utility of ITR Form No. 5:

At present, the utility of ITR Form No. 5 is computing the late fee under Section 234F of the Income-tax Act, 1961 which is actually not leviable/applicable, since the return is filed within the time specified under the provisions of Section 139(1) of the Income-tax Act, 1961. Kindly refer to the representation no. ICAI/DTC/2018-19/Rep – 31 dated 07th September,2018 highlighting the same issue.

Further For Attention of members carrying out tax audit u/s 44AB of the Income-tax Act,1961.

Attention of members is invited towards the changes in the Guidance Note on tax Audit under section 44AB of the Income-tax Act, 1961 approved subsequent to the publication of the Supplementary Guidance Note, issued by the erstwhile Fiscal Laws Committee, as a part of the publication “Guidance Note on Audit of Fringe Benefits under the Income-tax Act, 1961” in 2006.

The Fifth Edition of the Guidance Note on Tax Audit under section 44AB of the Income-tax Act, 1961 incorporating the law as amended by the Finance Act, 2005 was published in September, 2005. Subsequently, a supplementary Guidance Note has been published on the amendments made by the notification No. 208/2006 dated 10th August, 2006 issued by the Central Board of Direct Taxes in Form No. 3CD.

Subsequent to the publishing of the above Supplementary Guidance Note, the Finance Act, 2007 has made amendments in section 40A(3). New Rule 6DD was inserted in the Income-tax Rules by notification No. 208/2007 dated 27.6.2007 w.e.f. A.Y. 2008-09.

The Council thereupon approved some more changes subsequent to the publication of the Supplementary Guidance Note. These may be taken into consideration while reading in the Guidance Note on Tax Audit [2005 Edition] and the Supplementary Guidance note on Tax Audit [2006 Edition published along with the Guidance Note on Audit of Fringe Benefits under the Income-tax Act, 1961].

For convenience of members the clauses wherein there have been changes are listed hereunder and the full text which forms part of the Guidance to members is available at

ICAI Please note that some changes approved relating to fringe benefits have not been given here since they are no longer relevant.

- Clause No. 12(a) and (b) of Form 3CD Para No. 23 of the Guidance Note[2005 Edition]

- Clause 17(h) of Form 3CD Para 35 of the Guidance Note (Subsequent changes have been made in section 40A(3) by the Finance Act, 2008 and Finance (No. 2) Act, 2009 and also in Rule 6DD.These changes may have an effect on the computation of the amount to be reported but no further guidelines in this regard is considered necessary)

- Clause 17(l) of Form 3CD

- Clause 17A in Form 3CD – Amount inadmissible under section 23 of the Micro, Small and Medium Enterprises Development Act, 2006.

- Select issues in accounting for state level VAT. (These do not represent the views of the Council but are based on the original draft prepared by Indore Branch of the CIRC of the Institute.)

In this connection, we would also like to invite the attention of members towards the announcement dated 12.12.2008, in the light of which from the A.Y.2010-11, an internal auditor of an assessee cannot be appointed as his tax auditor.Click here for Announcement and further clarification regarding applicability of the same for tax audit relating to financial year ending 31st March, 2010.

Issue in utility of ITR Form No. 5:

At present, the utility of ITR Form No. 5 is computing the late fee under Section 234F of the Income-tax Act, 1961 which is actually not leviable/applicable, since the return is filed within the time specified under the provisions of Section 139(1) of the Income-tax Act, 1961. Kindly refer to the representation no. ICAI/DTC/2018-19/Rep – 31 dated 07th September,2018 highlighting the same issue.

Refer this screenshot for further relevance.

Reiteration of Suggestion:

In view of the above reasons and the reasons stated in our earlier representation, we suggest and request that the due date of filing returns of income under section 139(1) of the Income-tax Act, 1961 for assessees mentioned under clause (a) of Explanation 2 to section 139(1) and also the ‘specified date’ for filing tax audit reports be extended from 30th September, 2018 to 31st October, 2018 for AY 2018-19 as also the due date for filing tax audit reports.

We reiterate our request to grant an appointment to the undersigned as per your convenience to enable us elaborate our viewpoints.

We hope that our concerns would be favourably considered.

Yours faithfully,

-Sd-

Chairman, Direct Taxes Committee

The Institute of Chartered Accountants of India